UK Child Tax Credit

Welcome to UK Living Tips, in this Article we going to talk about. The UK Child Tax Credit (CTC) system can feel like a labyrinthine maze for many parents. Understanding its intricacies is crucial, especially as the landscape of benefits and financial support continues to evolve. This article aims to provide a clear, compassionate guide to the CTC in 2025, addressing potential questions and concerns with a human touch. While we can’t predict the exact details of the 2025 scheme – governments change policies – we can explore the current system and likely future trends based on existing policies and economic forecasts.

READ ALSO: Exploring the Different Types of Childcare in the UK in 2024

Overview

What is the Child Tax Credit?

At its core, the Child Tax Credit is a means-tested benefit designed to help families with the costs of raising children. It’s a payment made directly to the parents or guardians of eligible children, offering financial assistance that can significantly ease the burden of childcare, food, clothing, and other essentials. The amount received varies based on individual circumstances, including income, number of children, and other factors we’ll explore in detail.

How to login Child Tax Credit account online

Child Tax Credit account online, you will probably need to:

- Go to the Official Government Website: The primary source for accessing government services in the UK is GOV.UK. Search for “Child Tax Credit” on this website. Be extremely cautious of any other websites claiming to offer access—ensure you’re on the official government site. Look for the official government logo and secure HTTPS connection.

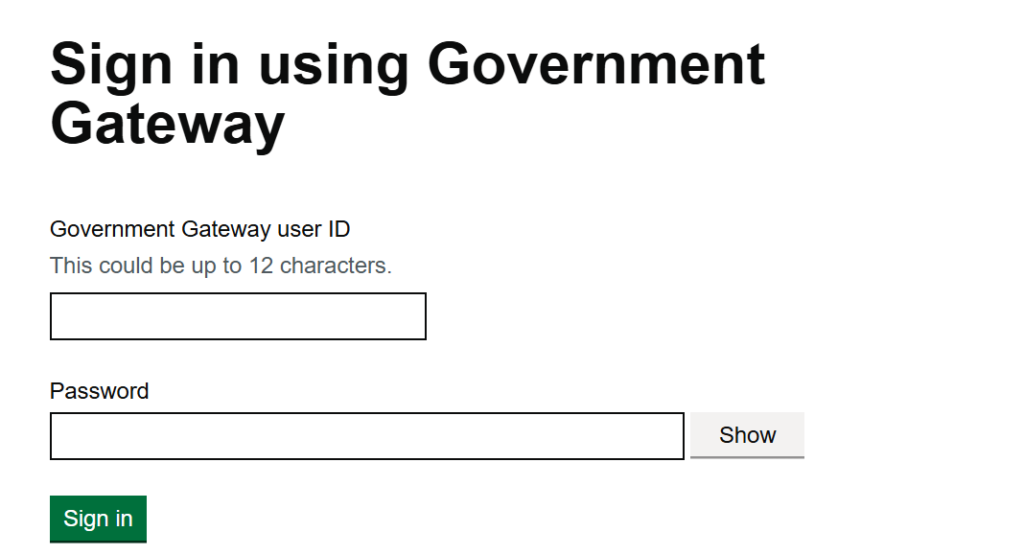

- Use Your Government Gateway Account: The UK government utilizes the Government Gateway as a single point of access for many online services, including benefits. You’ll likely need a Government Gateway user ID and password. If you don’t already have one, you’ll need to create one beforehand using the instructions provided on GOV.UK. This will involve verifying your identity.

- Login: Once on the correct Child Tax Credit page within GOV.UK, you’ll be prompted to enter your Government Gateway credentials (username and password).

- Security Measures: Expect robust security measures. This may include multi-factor authentication (like a code sent to your phone) to verify your identity.

- Account Navigation: Once logged in, you should be able to access your Child Tax Credit information, update details, and manage your account.

Important Security Considerations:

- Never share your Government Gateway login details with anyone. The government will never ask for your password via email or phone.

- Be wary of phishing scams. Fraudsters often attempt to mimic government websites to steal personal information. Always double-check the URL and look for security indicators (like the padlock symbol in the address bar).

- Keep your contact details up-to-date. This will ensure you receive important notifications from the government regarding your Child Tax Credit.

Who is Eligible for the Child Tax Credit in 2025

Eligibility for CTC in 2025 will likely remain dependent on several key factors:

- Residency: You must be a UK resident and usually resident in the UK.

- Income: Your income will play a central role. CTC is means-tested, meaning the higher your income, the lower the amount you’ll receive, or you may not be eligible at all. This will likely persist in 2025. The exact income thresholds may change, so keeping an eye on government updates is essential.

- Children’s Ages: Children must generally be under the age of 16, or under 20 and in full-time education or an approved training course. This age criterion is unlikely to change drastically.

- Working/Job Seeker’s Allowance: You might be eligible even if you don’t work, provided you meet certain criteria and are claiming benefits like Job Seeker’s Allowance.

- Disability: Additional support may be available if you or your child has a disability. This element is likely to remain a crucial aspect of CTC eligibility.

Calculating Your Potential Child Tax Credit

Predicting the exact amount in 2025 is impossible without specific policy updates. However, let’s illustrate how it currently works to give you a sense of the process:

Imagine Sarah and Mark, a couple with two children (aged 5 and 8) and a combined annual income of £25,000. Currently, they would receive a certain amount per child. This amount is adjusted based on their income. Higher incomes lead to lower payments, and ultimately, a point where they wouldn’t receive any CTC at all. This tapering system aims to direct support towards those who need it most.

Factors influencing Sarah and Mark’s potential 2025 CTC include:

- Inflation: The value of the CTC will be affected by inflation. Expect adjustments to reflect the rising cost of living.

- Government Policy: The government may choose to increase or decrease the amount, alter income thresholds, or introduce new eligibility criteria. This is the biggest unknown factor.

- Family Circumstances: Any changes to their income, number of children, or disabilities would impact their CTC.

Beyond the Basics

The CTC isn’t just a simple payment; it’s a system with several crucial elements:

- Childcare Costs: The CTC can help cover some childcare costs, especially for working parents. This element is often viewed as one of the most valuable benefits of the CTC.

- Disability Supplements: Additional payments are made for children with disabilities, recognizing the increased costs associated with their care. The details of this supplement are likely to be maintained or even enhanced in the future.

- Working Tax Credit (WTC) Integration: The CTC and WTC were previously separate, but are now largely integrated. This simplifies the process for many families.

- Application Process: Applying is usually done online through the government website (GOV.UK), a process that is continually being updated for greater user-friendliness.

Challenges and Concerns Regarding the Child Tax Credit

While the CTC provides valuable support, challenges remain:

- Complexity: The application process and understanding eligibility criteria can be confusing for many. Improved clarity and simplified guidance are always needed.

- Means-Testing: The means-tested nature can create a disincentive to work for some families, as increased income can lead to a reduction in CTC. Policymakers continually grapple with finding the right balance.

- Adequacy: Many argue that the CTC isn’t sufficient to cover the true cost of raising children, especially in the face of rising inflation. This is a recurring area of debate and potential future reform.

- Digital Divide: Access to technology and online application processes can exclude those without sufficient digital literacy or internet access. Addressing this digital divide is paramount for ensuring equitable access to the benefits.

Potential Changes to the Child Tax Credit in 2025

Predicting the future of the CTC is difficult. However, based on current trends, potential changes could include:

- Increased Payments: To combat the rising cost of living, there might be an increase in the amount paid per child, or adjustments to income thresholds.

- Policy Shifts: The government’s overall approach to social welfare could influence the CTC. Changes in political priorities may lead to alterations in eligibility criteria or payment amounts.

- Simplified Application: Efforts to streamline the application process are likely to continue, with a focus on improved user experience and online accessibility.

- Greater Integration with Other Benefits: Further integration with other benefits could simplify the system for families claiming multiple forms of support.

Seeking Help and Further Information

Navigating the CTC system can be challenging, but support is available. Don’t hesitate to contact the following resources:

- GOV.UK: The government website is your primary source for information, applications, and updates.

- Citizen’s Advice: Citizen’s Advice bureaus provide free, impartial advice on benefits and other financial matters.

- Local Councils: Your local council may also offer support and guidance on accessing benefits.

Conclusion

The Child Tax Credit remains a vital lifeline for many families across the UK. While the exact details of the 2025 scheme remain to be seen, understanding the current system and potential future trends is essential. By staying informed, actively seeking support when needed, and engaging with relevant organizations, parents can navigate the complexities of the CTC and secure the financial assistance they deserve to provide for their children. Remember, it’s a system designed to help, and understanding its intricacies is the first step toward accessing the support you need. Regularly check GOV.UK for the most up-to-date information as the 2025 details become available.