Stamp Duty in the UK: Hey there! So, you’re thinking about buying a home or a piece of property in the UK? One thing you’ll need to factor in is Stamp Duty. It might sound a bit intimidating, but don’t worry—we’re here to break it down for you in simple terms.

What is Stamp Duty in the UK?

Stamp Duty is a tax you pay when you buy a property or land in the UK. Officially known as “Stamp Duty Land Tax” (SDLT), it’s a way for the government to collect some revenue from property transactions. It’s calculated based on the purchase price of the property and can vary depending on a few factors.

Read also: School Holidays UK 2024

Overview

When Do You Pay Stamp Duty in the UK?

You’ll need to pay Stamp Duty if you:

- Buy a residential property: This includes a new home, a second property, or an investment property.

- Purchase land: If you’re buying a plot of land with plans to develop or hold onto it.

How Much Stamp Duty Will You Pay?

The amount of Stamp Duty you owe depends on:

- Price of the Property: Stamp Duty is tiered, meaning different portions of the property price are taxed at different rates.

- Property Type: There are different rules for residential properties compared to commercial ones, and additional rates for second homes or buy-to-let properties.

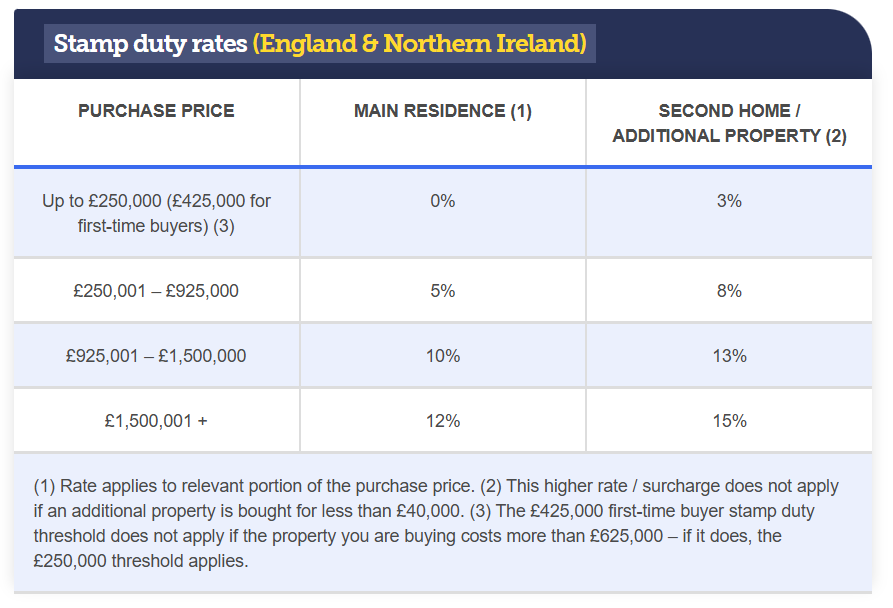

- Stamp Duty Rates: Here’s a simplified breakdown:

- 0% on the portion of the price up to a certain threshold.

- Higher rates on the portions above that threshold, with increasing rates for more expensive properties.

Recent Changes and Exemptions

Stamp Duty rates and thresholds can change, so it’s always a good idea to check the latest information. Some exemptions and reliefs include:

- First-Time Buyers: You might be eligible for relief or pay no Stamp Duty up to a certain limit.

- Higher Rates for Additional Properties: If you’re buying an extra property, like a second home or buy-to-let, you might face higher Stamp Duty rates.

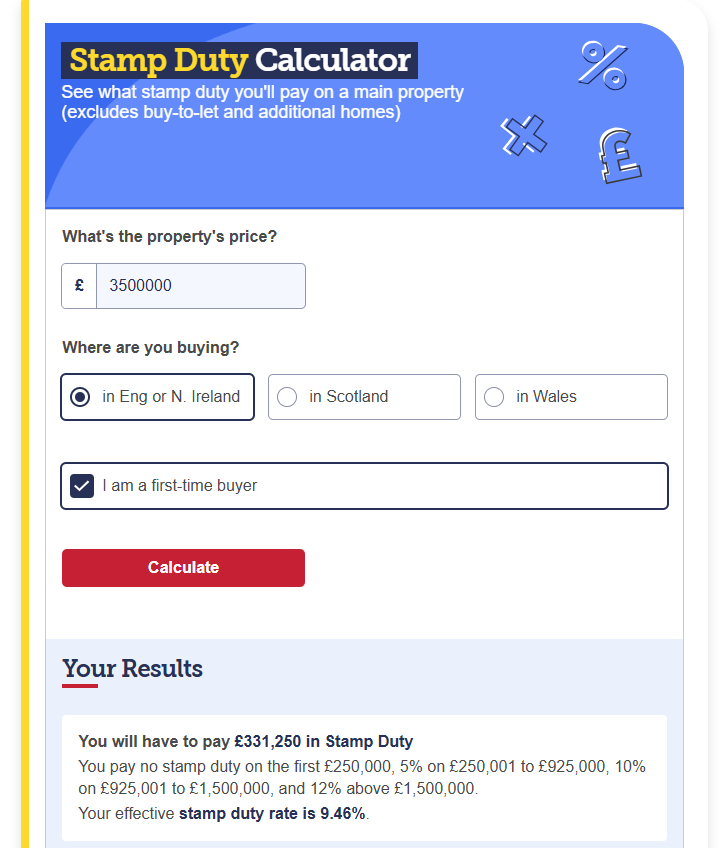

Calculate your Stamp Duty in the UK on the below link

Click here ……

Special Considerations for Work Visa Holders and ILR (Indefinite Leave to Remain) Candidates

If you’re on a work visa or have ILR, there are a few things to keep in mind regarding Stamp Duty:

Work Visa Holders

- Eligibility to Buy Property: There’s no restriction on buying property in the UK based on your visa status, so you’re free to purchase a home or land.

- Stamp Duty Rates: The same Stamp Duty rates apply to you as to other buyers. However, if you’re purchasing an additional property, the higher rates for second homes will apply.

- Financing Your Purchase: If you’re on a work visa, you may need to provide additional documentation when applying for a mortgage, but this won’t affect your Stamp Duty obligations.

ILR Candidates

- Eligibility to Buy Property: If you have ILR, you have the same rights as a British citizen when it comes to buying property. There are no additional restrictions or Stamp Duty rules specific to ILR holders.

- Stamp Duty Rates: Like any other buyer, you’ll be subject to the same Stamp Duty rates and thresholds. The only thing to watch out for is whether you’re buying your first property or an additional one.

- Mortgage Considerations: If you have ILR, you might find it easier to secure a mortgage, but it won’t change your Stamp Duty liabilities.

How to Pay Stamp Duty

Here’s how you handle Stamp Duty:

- Complete the SDLT Form: This is usually done online.

- Pay the Tax: Payments go to HM Revenue and Customs (HMRC), often facilitated by your solicitor or conveyancer.

Why Is Stamp Duty Important?

Stamp Duty can be a significant cost, so it’s important to budget for it as part of your property purchase. Ensuring you get it right avoids legal and financial headaches down the line.

So, there you have it! Stamp Duty might seem a bit complex, but understanding it is crucial for a smooth property transaction. If you have any doubts or need advice, speaking to a professional is always a smart move. Happy house hunting